Consumer website for Vesting Finance

Under the motto "Building better financial futures", Vesting Finance works to solve debts and prevent debt through education. An important part of this is the consumer section of the website.

Financial struggles

It can happen to anyone: financial struggles. Shuffling bills, requesting payment extensions, penalty clauses, and hoping for a financial miracle every month.

When you have debt, you have worries. Uncertainty and shame often accompany this. Climbing out of the hole can be very difficult and challenging. And it's really hard to find the right way out. Getting back on track doesn't happen automatically.

If you're not careful, you can quickly run into bailiffs and debt collection agencies. Not cool at all, but also understandable: creditors want to see their money. Unfortunately, this often means additional costs and even more debt.

Building better financial futures

Thus, prevention is better than cure. Fortunately, more and more debt collection agencies and debt collectors are realizing this. That's why Vesting Finance is focusing more on consumers and education. Under the motto 'Building better financial futures', Vesting Finance is working on debt prevention through information provision. An important part of this is the 'Master of your Budget' campaign, which consists of useful tools, tips, and information about budget management. With this help, consumers can regain control over their financial situation.

A condition for innovation was to support not only the business customers of Vesting Finance but also the consumer group effectively. This includes providing preventive information, as well as information on what to do when in contact with Vesting Finance. They approached Novaware with this challenge.

To clarify what was needed, we used a concept sprint. During this sprint, we worked on clear wireframes to show how this section for the consumer audience would look.

The intention was not to completely renew the website. Therefore, the consumer section was largely designed within the current environment. However, new ideas also emerged that would fit well within other parts of the existing website. That's why the entire website received a refresher and was expanded with new functionalities that immediately solved some technical bottlenecks in the existing environment. For example, the chat function was also improved, which is ideal for consumers to quickly ask a question.

Pay and settle

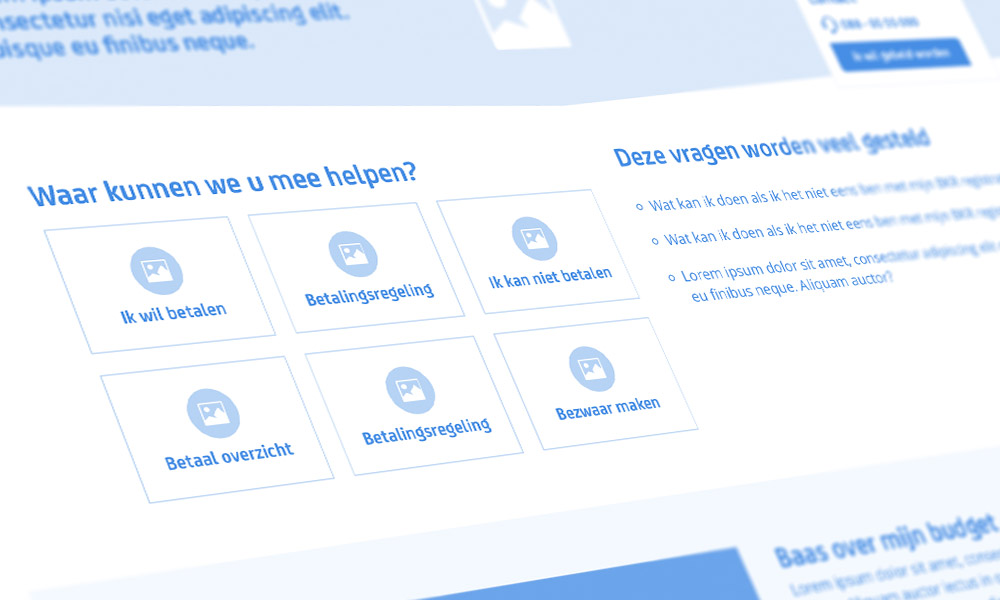

The consumer section is fully focused on helping the consumer quickly. Data showed that consumers whose case is being handled by Vesting Finance want to take certain actions. Such as making a payment, arranging a settlement or requesting a deferment.

We designed clear action buttons for all these actions. By clicking on a button, the process of, for example, requesting a payment deferment starts. In most cases, you can fill in an action-specific form or log in (when your case is already known). The information entered is then immediately forwarded to the correct department.

In addition to the action buttons, many questions are answered. This addresses a large part of the questions that would normally be directed to the help desk. By providing answers online, users are helped immediately without any waiting time. This optimised the process for both the consumer and Vesting Finance.

Master your budget

Helping and supporting consumers who have a case with Vesting Finance online is one thing, but the second is preventing looming financial problems from growing into debts. And that starts with information.

Under the heading 'Master Your Budget', Vesting Finance provides useful tools, tips and information about budget management. Because the most important thing in gaining control over your financial situation is insight. The explanation videos, tips, themes and carefully selected toolbox can help users regain control over their finances. This helps people get their finances back in order and prevent them from building up problematic debts.